For over a decade, the financial services sector has made significant investments in developing data warehouses and business intelligence systems. No doubt, a data warehouse is an invaluable asset for financial companies, helping them leverage historical and current data to make better business decisions.

Although stakeholders are leveraging undeniable value from data warehouses, running them into an on-premise data center causes challenges for financial institutions. Traditional data warehouses are expensive to scale and were not built to support raw and unstructured data and run complex queries which are common with modern applications.

Interestingly, cloud computing with its virtually unlimited storage, unparalleled scalability, and pay-as-you-go offerings presents an enticing alternative for financial sector companies to develop, store, and process sizable amounts of data easily and cost-effectively.

Why Is A Data Warehouse Critical To A Company’s Success?

A company develops a data warehouse to build a centralized information infrastructure comprising historical data to generate powerful insights to understand past successes and failures to support better future decisions.

A data warehouse stores structured data that is being cleaned and processed before entering into the defined schema. It makes data readily available for strategic analysis and supports predefined business models to extract desired information. Here are some other advantages of a data warehouse within a financial institution:

- Unified view of business health

- Improved data quality

- Quick access to information

- Fast & Simple Data Analysis

What Are The Challenges With Traditional Data Warehouse?

Modern enterprises require to quickly transform and analyze large amounts of data to enable digital strategies. Traditional data warehouses due to being built on lagging legacy systems, lack the efficiency to support the evolving business needs. Here are the following challenges finance companies face with on-premise data warehouses.

- Outdated technologies that don’t scale and have long load times.

- Redundant ETL methods.

- Higher administrative costs.

- Significant upfront investment to support new innovation infrastructure.

- Proprietary formats and siloed data make the process complex to access, refine, and join data from different sources.

- No support to segregate cold and warm data to support modern analysis and reporting requirements.

- The limited scope of using the system by the number of users and the amount of accessible data.

How Amazon Redshift Outperforms Traditional Finance Data Warehouses?

Amazon Redshift is a fully managed data solution that is built to support petabyte-scale data warehousing needs. It is based on PostgreSQL and delivers incredibly fast performance using two key architectural elements: columnar data storage and massively parallel processing design.

Through its ability to perform SQL-based queries on large databases containing a mix of structured, unstructured, and unstructured data, Amazon Redshift has emerged as the leading cloud data solution in the market.

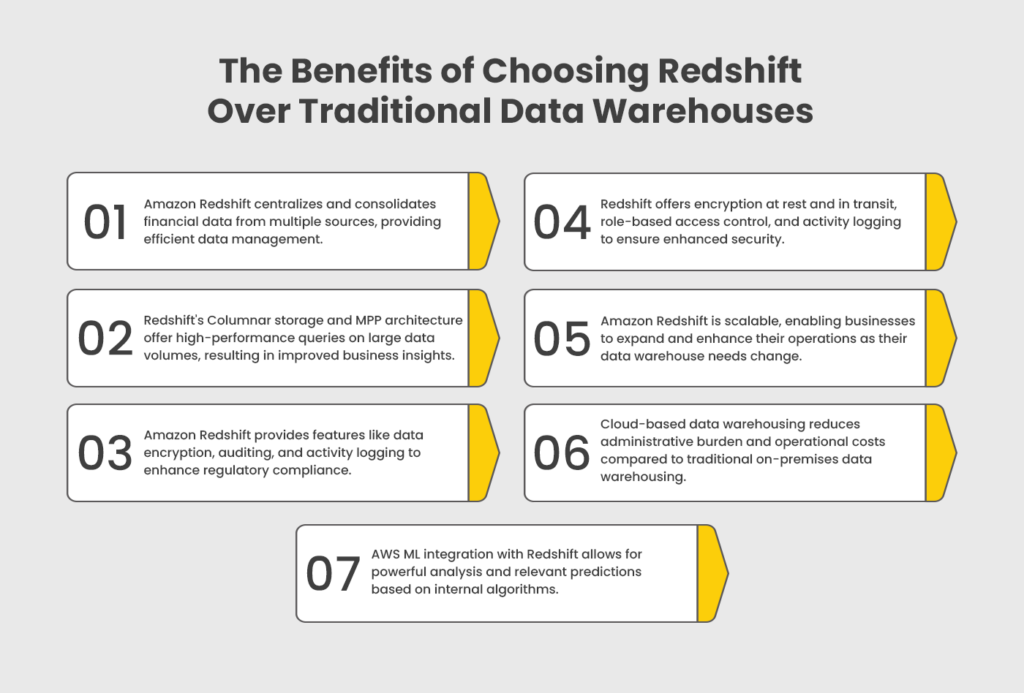

One of the most interesting things is that business intelligence tools are adept at exploiting raw data stored in cloud-based data warehouses and support generating actionable business insights. There are also several other benefits of using Redshift as your data warehouse for your finance business:

More Efficient Data Management

As a cloud-based data warehouse, Amazon Redshift helps you manage your financial data more efficiently.

- It centralizes and consolidates large amounts of data from multiple sources like employee documents, emails, enterprise applications, and more and provides flexible storage, computing, and processing power critical for you to avail quick, data-driven decisions.

- There are several features offered by Amazon Redshift that simplify the tasks of loading, querying, and updating data.

- Data integrity remains intact in Redshift no matter how many users such as marketing users, data scientists, and others use the system simultaneously.

- Amazon Redshift Spectrum allows for querying data from external sources without requiring the data to be loaded into Redshift beforehand.

Improved Business Insights

By more efficiently managing your data, you improve your business insights. Amazon Redshift enables you to quickly perform queries on massive datasets and generate reports that provide deeper insights into your customers, business operations, and market trends.

- A cloud data warehouse is built to overcome the limitations of traditional technologies. Hence Redshift stores data in a highly structured and unified format and makes the data an at-the-ready format to support a wide variety of specific business intelligence and analytics use cases.

- As it supports Columnar storage, Redshift provides a flexible and economical way to do analytics with your historical and real-time data.

- It leverages MPP architecture hence offering high-performance queries on large data volumes. MPP architecture leverages many servers running in parallel to distribute processing and input/output (I/O) loads and provide real-time visualization, analytics, and reporting.

- It allows you to connect and drill down on the information at a much deeper level critical to your operations, sales, client experiences, and overall strategic insight.

Improved Regulatory Compliance

Using Amazon Redshift enables you to improve your financial regulatory compliance.

- Amazon Redshift can aid businesses in achieving compliance with regulations set by FINRA and SEC. It offers various features such as data encryption, auditing, and activity logging to meet these requirements.

- Its auditing capabilities make it easier for you to track who accesses what data and when. Insights like this will help you in the event of a data breach or other security incident.

- As a cloud-based resource, you can easily add more storage and computing resources as your compliance needs grow.

Enhanced Security

As financial services companies deal with more sensitive data, it becomes crucial for them to have a secure solution for their data warehousing needs.

- Amazon Redshift offers several data protection features such as encryption of data at rest and in transit, role-based access control, and activity logging.

- The service seamlessly integrates with AWS Identity and Access Management (IAM), which simplifies the management of user permissions and the control of access to resources.

Scalability

As businesses evolve, their data warehousing requirements may also change. Amazon Redshift has the capability to extend and enhance business operations due to its scalability. The service can effortlessly scale up or down to meet fluctuating demands, and you are only charged for the resources you utilize.

- By adding more nodes to your cluster, you can boost query performance and concurrency in a linear fashion.

- By modifying the node type, you can alter the price-to-performance ratio, enabling you to optimize for speed or cost.

- With Amazon Redshift, you have the option to increase the size of your current nodes. Expanding the storage will not affect the CPU count or RAM amount.

Less Administrative Burden And Reduced Operational Cost

An on-premises data warehouse needs a dedicated server room, costly hardware, and trained employees to manage, upgrade and fix problems. In contrast, a cloud data warehouse doesn’t need physical hardware or office space, reducing operational costs.

- Cloud-based data warehouses offer you the opportunity to reduce your hardware expenses by avoiding the need for hardware expansion.

- You can significantly decrease the maintenance responsibilities by practically eliminating the expenses related to personnel, licenses, and hardware replacements.

- Pay-per-use billing is yet another advantage of the cloud-based data warehouse as it separates storage and compute for performance and scalability requirements and you pay for storage and compute used.

Integration with machine learning

Redshift’s integration with the AWS cloud ecosystem allows for various benefits, such as its ability to work in tandem with the AWS Machine Learning (ML) service.

- Despite Redshift’s rapid ETL operations, data scientists are still required to create their own analysis algorithms.

- This is where AWS ML comes in, as it provides a powerful service that utilizes internal algorithms to process data and deliver relevant predictions.

- The integration of AWS ML with Redshift as a data source elevates the potential of this DWaaS even further.

Why Use AWS For Financial Data Warehouse Modernization?

Having a complete cloud ecosystem in place, AWS offers a suite of products and services to build and manage data warehouses on the cloud. A data warehouse and business intelligence workflow typically involve three functions:

- ETL data using a tool.

- Storing and managing data in a data warehouse.

- Generating information from the data using business intelligence.

Each of these functions can be efficiently performed using an AWS service. For instance, ETL can be accomplished using AWS Glue, data warehousing with Amazon Redshift, and business intelligence through Amazon QuickSight.

By leveraging these AWS services, organizations can consolidate their DWBI technology usage and quickly adapt to these services, as their engineering team can readily apply their DWBI expertise to these tools.

Using AWS Data Warehouse solutions offers a significant advantage as it allows organizations to streamline their technology usage while continuing to support critical business functions.