The last decade has seen a massive disruption in the traditional banking and finance industry. Businesses along with the customers have switched to digital means for payment transfer and we have seen FinTech startups mushrooming around digital payments, digital investment, digital capital raising, digital assets, and neo-banking scenarios, among those digital payments, have the largest transaction volume.

Fintech products and services that were once considered avant-garde in their approach have become mainstream now, imposing convenience in areas of payments, online lending, wealth management, retail banking, and others. Though the finance industry once leveraged the most advanced technology to build digital products and services, their whole deployment is now rooted in legacy systems.

As they say, “today’s technology is tomorrow’s obsolete”, Fintech technology companies are required to upgrade or modernize their products and services at frequent intervals. Some fintech apps even need regular checks, maintenance, and support to be in alignment with new business ideas or market competition since technology never stops evolving.

What Are The Challenges Faced By Fintech?

As a financial technology tool, fintech applications require to be always on and available to their users. Top of it is these applications support financial transactions, hence are prone to cyber-attacks and regulatory, compliance, and governance requirements. Moreover, every transaction generates data that also need to be secured while in transit and at rest. Implementing proper authentication and authorization is yet another challenge in Fintech since this is the area that today’s hackers are most likely to target.

Managing all such scenarios in one go while ensuring consistency and uninterrupted experience on the fintech application again requires financial technology companies to continue to embrace new technology as they emerge. With this goal in mind, FinTech companies have begun to innovate new solutions which include embracing the cloud within their infrastructures. The industry is seeking to build new products and modernize old systems keeping future integration requirements in focus.

How Cloud Technology Helps Fintech Evolve?

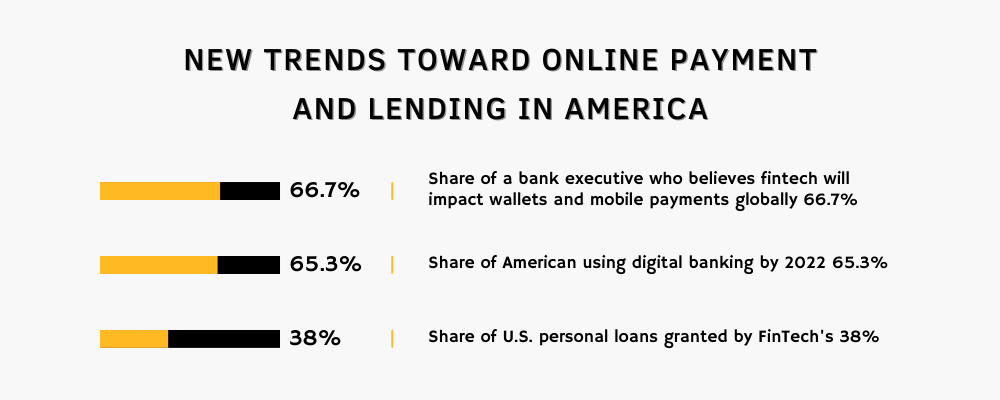

FinTech companies are rapidly turning to the cloud to provide businesses and consumers with effective solutions. According to Statista, Fintech with cloud computing is contributing significantly to developing innovative technological solutions in such areas as online and mobile payments, big data, alternative finance, and financial management. It is driving new trends toward online payment and lending in America as Statista stats depict:

There is also another report published by JP Morgon that demonstrates the shifting consumer behavior of US consumers using online payment and how it is influencing businesses to integrate cashless POS.

- Digital wallets are another contactless payment method slowly being adopted in the U.S., particularly among younger consumers.

- According to the Federal Reserve, debit cards are currently the most frequently used payment method in the U.S.

- At a growing number of convenience-oriented stores in the U.S., sophisticated digital sensing and communication technology are used in developing digital wallets that seamlessly authenticate consumers’ identity and authorize the correct payment at a self-checkout point.

Let’s check how cloud computing is imperative for FinTech companies for growth and in developing better fintech solutions.

1. Modernizes and Migrates Mainframe Application

Legacy systems or mainframes are built on old programming languages such as COBOL. Fintech application deployment is not an exception, hence financial technology companies face the business risk of reduced skills to support legacy technologies and increased operations and maintenance costs. Fintech companies can leverage the cloud to migrate and host mainframe data with high-quality code written using future-focused languages such as Java, Python, C#, and others ensuring seamless migration and maintainability on the cloud.

Financial technology companies can also decide to leverage legacy application modernization practices to segregate monolith applications into a microservices architecture. Microservices architecture allows a choice of programming language best suited to a specific function, enabling the speed to market. Since microservices components are packaged into containers that are agnostic to operating systems, fintech companies can achieve agility and innovation at once.

2. Enable Security With Hybrid Cloud

Fintech faces the constant risk of managing sensitive information and complying with industry regulations. Cloud providers implement strict measures to safeguard their customers’ data and systems against threats and attacks, using techniques like next-gen firewalls, intrusion detection and prevention technologies, endpoint security, data encryption, audits, penetration testing, tokenization, and VPNs.

Banks and financial institutions consider data center breaches and the compromise of sensitive information their worst nightmare. However, cloud platforms offer a solution by providing data center authentication and eliminating the possibility of attacks. With hybrid cloud computing technology, all data stored in data centers are secure. Popular cloud providers like AWS and Microsoft Azure offer hybrid cloud computing servers that ensure end-to-end data protection. These servers guarantee the confidentiality, integrity, and availability of the most sensitive data.

3. Increase Integration Capabilities

Every year we experience improved methods of digital money transfer, for instance. These new capabilities once adopted by a particular fintech application quickly resonate with all other applications in the market. Businesses that delay the adaptation of these technologies, find it difficult to retain their customers.

Taking advantage of cloud computing doesn’t always mean a wholesale migration to a brand-new set of technologies. Cloud technology offers flexibility in several ways. Fintech companies can go with cloud-native solutions to build new solutions to lure new and retain existing customers. They can develop cloud-native applications that optimize business processes and make teams more efficient.

With the help of microservices architecture and APIs, they can spin up new services quickly, integrate, and build around the edges of existing platforms, and establish communication between multiple systems. Active use of APIs is yet another advantage that can be leveraged to promote intersystem connectivity essential to give customers the omnichannel experience be it web, mobile, kiosk, etc. It helps fintech companies ensure for customers a seamless journey across applications and brands and for efficient content-rich customer experiences and data-driven business decision-making.

Final Thoughts

As customers, both businesses and consumers demand more digital capabilities from financial technology companies, cloud integration allows them to adapt to those changing needs quickly and effectively. Cloud services allow fintech companies to capitalize on their existing technologies and invest in the future. Cloud help to centralize, manage, and utilize vital business data effectively, let siloed systems communicate and scale on-demand transactions of elastic commerce integrated with a non-elastic accounting system, all while keeping TCO low or under control.